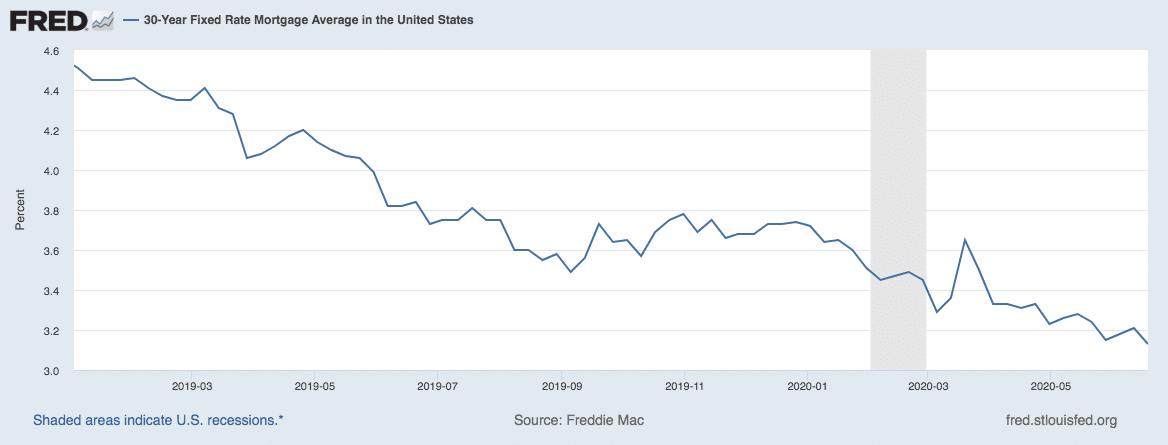

If there was ever a good time to borrow money to buy a house it’s now. Right now – as in, this week! (week of June 18, 2020). You can see in the graph above that the average 30 year fixed rate mortgage has been falling consistently since January 2019.

Since 1990 the Mortgage Bankers Association (MBA) has been conducting a weekly survey of mortgage interest rates. According to this week’s survey, interest rates are the lowest they have ever measured in the history of the survey.

The average rate on a 30 year fixed-rate home loan is 3.30 percent this week. That’s the average rate. For anyone with better-than- average credit – your rates can be even lower!

The 3.30 percent rate is for conforming loan balances – so check with your lender to see what rate will apply to your situation.

What does that mean for a home buyer? You are in the enviable position of borrowing money to buy a home at the lowest rate ever. EVER. That means you can pay much less per month than even a year or two ago. That means you can afford to buy a larger, fancier home and pay the same monthly payment that you would have a few years ago for a lesser house.

Anthony Sarwary is a Branch Manager and lending expert with Secure Provision Mortgage Corporation. Mr. Sawary gave his opinion on the this week’s mortgage interest rate environment, “Current mortgage interest rates are at the lowest I have seen in my 18 years of working in this industry. With the current rates available to consumers, if you’re thinking about buying a house, refinancing your primary home or even your investment property, you should drop everything you’re doing and get your loan application in now. Could rates go lower? Sure – but I don’t think this is a good time to roll the dice and potentially risk missing out on some of the lowest interest rates in history. “

If you already own a home – it would make a ton of sense to investigate if you can save money by refinancing your current mortgage. (Spoiler alert – you almost certainly can at these incredibly low rates.)

If you are in the market to buy a home you should know that these low rates are also attracting other potential buyers to the home purchase market. Mortgage applications to purchase a home are 21 percent higher than a year ago. That’s the highest amount in the past 11 years. So there will potentially be even more competition for the properties that are currently for sale. If you want an edge you can check out these tips for buying a home in South Pasadena.

If you have already purchased a home, contact your mortgage broker or lender to review your current mortgage debt and monthly payments. Chances are high that you can pay less every month.

Anthony Sawary made the following suggestions if you want to get started, “My advice for someone who is looking to take advantage of the low rates would be to contact several lenders to price and compare each offer. It is extremely important for you to work with an experienced loan officer that doesn’t just sell you on their rate and company but someone who has vast knowledge of the underwriting guidelines, loan parameters and the different scenarios that can come with purchasing a loan or refinancing a house.”

If you are considering buying a home, get your application into your lender to have a shot at locking in a once-in-a-lifetime interest rate for your home purchase. Be sure to seek out a capable realtor as well – to help you navigate the increased competition for buying that new home. If you want to work with a top realtor in South Pasadena – give me a call anytime.